Packaging giant to acquire MYPAK for 956M THB to bolster its Indonesian ‘Fajar’ operations; implements ‘Loose Coupling’ strategy to de-risk from China and target India as a new growth hub.

Despite navigating a challenging first nine months of 2025, marked by global economic volatility, lower selling prices, and a strong Thai baht, SCG Packaging (SCGP) is executing a significant strategic offensive.

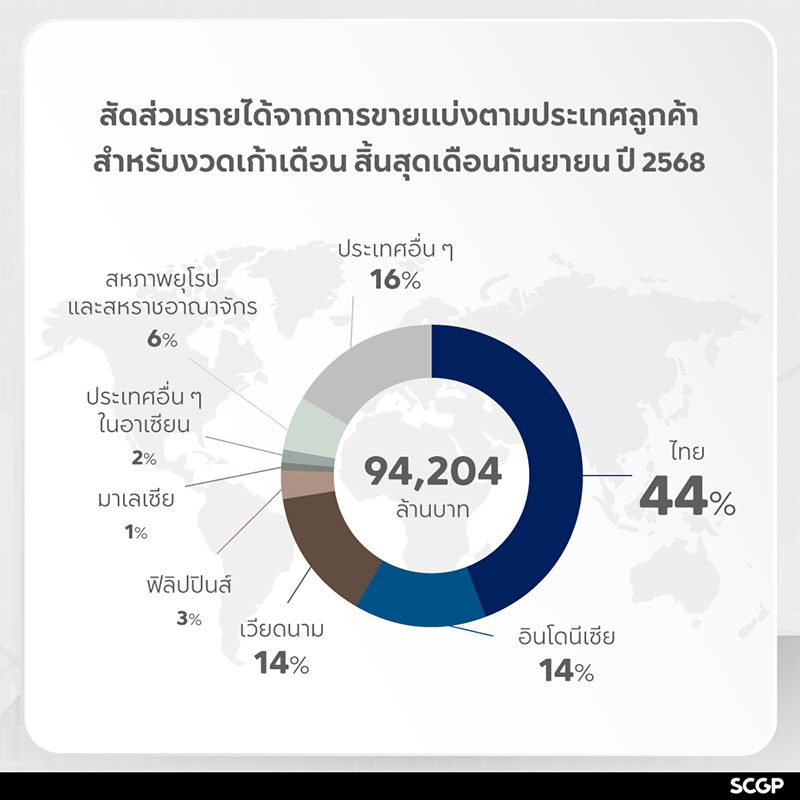

While 9M 2025 consolidated revenue was 94.2 billion THB (a 7% decrease YoY) and profit hit 2.87 billion THB (a 20% decrease YoY), the company’s Q3 2025 results signal a sharp recovery. Q3 profit attributable to the parent company soared by 65% year-on-year to 953 million THB, driven largely by improved performance in its Indonesian paper packaging business.

Now, SCGP is aggressively pursuing a three-pronged strategy to build resilience and new growth engines: a key vertical integration M&A in Indonesia, a strategic trade diversification away from China, and a decisive entry into the high-value healthcare market.

Strategy 1: ‘Loose Coupling’ from China, Targeting India

One of SCGP’s most critical adjustments is the strategic management of its export portfolio. Wichan Jitpukdee, Chief Executive Officer of SCG Packaging Public Company Limited or SCGP, detailed the company’s “Loose Coupling from China” strategy, which began in late 2024.

This proactive move was based on a forward-looking risk assessment. “We foresaw that China would be impacted by tariffs from the United States, which was a clear risk signal in international trade,” Wichan explained. “This factor required SCGP to diversify its customer base and markets to mitigate potential impacts.”

The results are stark: SCGP’s export share to China in the first nine months of 2025 was slashed from 8% of total exports to just 4%.

Crucially, this volume was not lost. The company’s sales teams successfully diverted these orders to high-potential new markets, chiefly India, along with Australia.

Wichan emphasized this is not a short-term “dumping” exercise. “SCGP views India as a strategic base for future investment,” he stated, framing the move as a long-term plan to learn the market and establish a strong foundation for future growth.

Strategy 2: 956M THB Deal to Cement Indonesian Supply Chain

Simultaneously, SCGP is deepening its investment in Indonesia, a market it views as a “rising star” with growth potential equivalent to Vietnam.

On October 28, 2025, the company’s board approved the 100% acquisition of PT Prokemas Adhikari Kreasi (MYPAK), a corrugated container producer. The deal, valued at up to 455 billion IDR (approx. 956 million THB), is expected to close in Q4 2025.

This acquisition is a key jigsaw piece for SCGP’s vertical integration strategy. Danaiate Ketsuwan, SCGP’s CFO, explained that while the company has a powerful “upstream” asset in Indonesia with PT Fajar Surya Wisesa Tbk. (Fajar), a major packaging paper producer, it lacked sufficient “downstream” converting assets (factories that make the final boxes).

The MYPAK acquisition, located near Fajar’s plant in Bekasi, West Java, directly fills this gap. It will immediately increase SCGP’s integration level (the percentage of its own paper it converts) in Indonesia from 18% to 26%. The long-term goal is to reach 50%, matching its operations in Thailand and Vietnam.

The deal is expected to add approximately 1.8 billion THB in annual revenue and brings a strong portfolio of multinational FMCG clients, creating cross-selling opportunities and enhancing cost efficiency.

Strategy 3: Beyond the Box—Entering the Medical Device Market

Reflecting a significant business model evolution, SCGP is making a serious push into “New Business,” spearheaded by its Healthcare Supply division. This unit alone is projected to generate 2.7 to 2.8 billion THB in sales this year.

The company’s latest move is a new investment in machinery to produce syringes and needles in Thailand. The facility is currently in its installation phase and is expected to begin commercial operations between January and February 2026.

The primary goal is clear: import substitution. SCGP aims to tap into the substantial domestic market for these medical devices, which are currently supplied primarily by imports. This move represents a significant “elevation” of the business, moving from a packaging specialist to a player in the complex, high-value medical solutions industry.

Brighter Q4 Outlook as Material Costs Shift

SCGP management expressed confidence in a strong Q4 2025, citing two key raw material trends:

- Pulp Prices: Global pulp prices, which bottomed out in Q3 after Brazilian producers resolved a tax issue with the US, are now rising in Q4, signaling a demand recovery.

- Recovered Paper (RCP) Prices: Conversely, RCP prices are on a downward trend in Q4. This is a direct result of China, a major importer, temporarily banning imports, creating a regional supply glut.

This dynamic—rising prices for its finished pulp and falling costs for its RCP input—is highly favorable. To capitalize on this, SCGP has proactively increased its use of domestic RCP to 65% (up from 55%) and boosted its use of renewable energy to 38.6%.

“We are confident that Q4 2025 results will be definitely better than Q4 of last year,” management stated, adding that full-year 2025 performance “should not be less than last year.”

EPR Regulation: From Challenge to Opportunity

Regarding the upcoming Extended Producer Responsibility (EPR) law in Thailand, which will directly impact the packaging industry, SCGP holds a counter-intuitive view: it is an opportunity, not a threat.

Management explained that SCGP already has extensive experience with EPR regulations in Europe and Vietnam and has built a robust recycling ecosystem. The company notes that the primary legal responsibility under EPR will fall on “Brand Owners,” not packaging producers.

SCGP plans to leverage its expertise and infrastructure to offer compliance solutions to these brand owners, turning the new regulation into a new service-based revenue stream. This aligns with its long-term sustainability goals, which include a 25% GHG reduction by 2030 and achieving Net Zero by 2050.

SCBX reports strong Q3 2025 net profit of Baht 12,056 million

CRC seeks shareholder approval for THB 14.7 Billion Rinascente sale